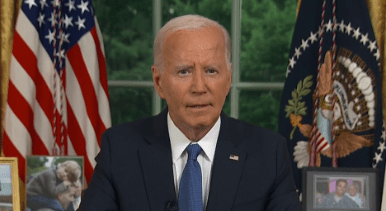

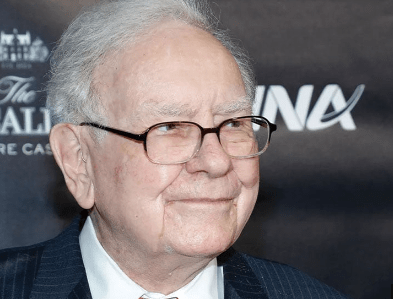

Warren Buffett’s Berkshire Hathaway (BRKA) Class A shares shocked investors on Monday morning due to a trading glitch that caused a dramatic plunge in the stock’s value. Trading was halted after quotes showed a near-total loss of value.

NYSE Technical Issue Leads to Major Drop in High-Priced Stock

The New York Stock Exchange (NYSE) experienced a technical issue within its data feed, leading to a significant drop of over 99% in one of the highest-priced stocks on the market. Berkshire Hathaway Class A stock was halted at 9:50 a.m. ET after shares plummeted to a low of $185.10 from over $622,000, which is consistent with its typical trading range.

An NYSE spokesperson stated, “After the market opened on the morning of June 3, 2024, a technical issue involving industry-wide price bands published by the Consolidated Tape Association’s Securities Information Processor triggered ‘limit-up/limit-down’ trading halts on up to 40 symbols listed on NYSE Group exchanges. Shortly before noon, the issue was resolved, and trading in the impacted stocks resumed. The NYSE is reviewing potentially impacted trades.”

Warren Buffett’s Berkshire Hathaway Temporarily Loses 99% Value

Berkshire’s Class A shares resumed trading at 11:30 a.m. ET at a price of around $640,000, according to Barron’s. Meanwhile, the lower-priced Berkshire Hathaway (BRKB) Class B shares dipped by about 1% but were not significantly affected by the quote problem. By the afternoon, B shares were down 0.8% in trading.

Other Stocks Impacted by the Glitch

The glitch also affected other stocks, including Barrick Gold (GOLD) and NuScale Power (SMR). Barrick Gold’s stock experienced a 99% drop, trading at $0.25 per share from around $17 per share. Trading was halted for Barrick stock at 9:56 a.m. ET.

Jennifer Lopez Cancels Summer Tour: “Completely Heartsick”

NuScale Power (SMR) showed similar effects, with the nuclear technology stock dropping to $0.13 from around $8 per share. In addition to Warren Buffett’s stock, Chipotle Mexican Grill (CMG) was modestly affected by the technical issue.

Understanding the NYSE Glitch and Its Impact

This trading glitch highlights the vulnerabilities in the stock exchange’s technological infrastructure. The incident underscores the importance of robust systems to handle high-value transactions and prevent market disruptions. The NYSE’s swift action to halt trading and resolve the issue within a few hours helped mitigate the potential fallout. However, such incidents raise concerns about the reliability of trading systems and the safeguards in place to protect investors.

Investor Reactions and Market Stability

Investors were understandably rattled by the abrupt drop in Berkshire Hathaway’s stock price. The temporary loss of 99% of the stock’s value would have resulted in substantial financial impacts had it not been a glitch. The quick recovery and resumption of trading at normal prices alleviated fears, but the event serves as a reminder of the unpredictability of the stock market.

Future Measures to Prevent Similar Incidents

Moving forward, it is crucial for the NYSE and other stock exchanges to implement more rigorous checks and balances to prevent similar incidents. Enhancing the robustness of data feeds and ensuring the reliability of price bands will be essential steps in safeguarding against future technical glitches. Additionally, increased transparency and communication with investors during such events can help maintain market confidence and stability.

The trading glitch that caused Warren Buffett’s Berkshire Hathaway stock to plummet by 99% served as a wake-up call for the stock exchange and investors alike. While the issue was resolved relatively quickly, the incident highlights the need for improved technological infrastructure and safeguards in the financial markets. By addressing these vulnerabilities, the NYSE can help ensure that such dramatic and unsettling events do not recur, thereby protecting investors and maintaining trust in the market’s integrity.